Want to generate a steady stream of income while you sleep? The internet offers a plethora of opportunities to monetize your knowledge. Dive into the world of passive income streams online, which allow you to generate revenue even when you're not actively putting in hours. From affiliate marketing, there's a perfect opportunity waiting for everyone.

- Launch your journey today and discover the potential of passive income.

Frugal Hacks: Supercharge Your Savings

Ditch the expensive spending routines and get thrifty with these incredible frugal tips.

You'll be amazed how small changes can result in big financial gains.

First, reduce those redundant costs. Make a budget and stick to it.

Next, get inventive with your shopping. look for deals and consider second-hand goods.

Finally, develop the routine to save regularly to your savings account.

Remember, every little bit helps!

Mastering Money: Budget Like a Pro

Taking control of your finances doesn't have to be stressful. With a little planning, you can create a budget that works for you and sets you up for financial success. Start by tracking your income and expenses. This gives a clear picture of where your money is going. Once you know your spending habits, you can begin to make changes.

Consider assigning specific amounts for sections like housing, transportation, food, and entertainment. Be truthful about your desires and prioritize what's most important to you.

Review your budget regularly to make sure it's still matching with your goals. Don't be afraid to implement changes as your situation evolves. Remember, budgeting is a process that requires discipline.

Mastering Your Finances: The Ultimate Guide to Saving Money

Cracking the code for financial success doesn't require a magic wand. It all starts with crafting a solid savings strategy and sticking to it. This ultimate guide will equip you with the tools and knowledge you need in order to transform your relationship towards money, creating a future filled and financial security.

First and foremost, assess the current spending habits. Track every dollar that leaves its wallet for a month or two. This will uncover areas where it can cut back and possibly redirect those funds towards your savings goals.

Consider adopting the 50/30/20 budget rule, allocating 50% of one's income to needs, 30% to wants, and 20% to savings and debt repayment. This framework offers a structured approach to managing your finances and ensures that saving is never a priority.

Consider automate one's savings by setting up regular transfers from your checking to a dedicated savings account. This prevents the temptation to spend those funds and makes saving a seamless, effortless process.

Begin Your Investment Journey: A Simple Approach

Embarking on your financial journey can seem daunting, but it doesn't have to be. By following a structured approach, you can confidently begin building a portfolio that supports your financial goals. First, establish your capital objectives click here and time horizon. This will help you select suitable asset options.

- Analyze different investment instruments, such as stocks, bonds, mutual funds, and ETFs.

- Diversify your investments across various asset classes to mitigate risk.

- Start small and incrementally increase your investments over time.

- Monitor your portfolio's performance regularly and make adjustments as needed.

Keep in mind that investing involves risk, and past performance is not indicative of future results. It's important to perform thorough research, understand your risk tolerance, and seek professional advice when necessary.

Boost Your Finances : Smart Investment Strategies

Securing your financial future is a goal many/several/a good amount of people strive for. To achieve/accomplish/attain this, smart investment strategies are crucial. Begin/Start/Kick off your journey by diversifying/spreading out/allocating your investments across different/various/multiple asset classes, such as stocks, bonds, and real estate. This reduces/mitigates/lowers risk and increases/amplifies/boosts your chances of success/profitability/growth.

Research/Explore/Investigate investment options thoroughly before committing your funds/money/capital. Understand the risks/volatility/potential downsides involved and align/match/ensure your investments with/to/toward your financial goals/objectives/aspirations.

Consider consulting/seeking advice from/talking to a qualified financial advisor who can provide/offer/give personalized guidance based on/tailored to/in line with your unique circumstances. Remember/Keep in mind/Be aware that investing is a long-term/extended/ongoing process, and patience/persistence/steadfastness is key to achieving/attaining/reaching your financial objectives/goals/targets.

Alicia Silverstone Then & Now!

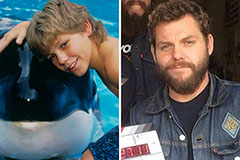

Alicia Silverstone Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Shane West Then & Now!

Shane West Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!